One of the key requirements of the commodity companies is to have effective market price control. Once the pricing strategy is decided, next step is the control. When there is no price uniformity in the market, doubts start creeping in on the business practices of the company and ultimately the quality of the product. Channel partners begin questioning the modus operandi of company officials and start drifting away from the brand. Proper market price control

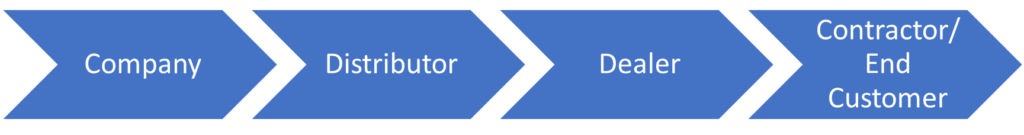

The material flows from the company to the end user through several intermediaries and market price control at each stage is important for the company.

Challenges to Market Price Control

Several factors in the business environment can be impediments to a company for market price control. Companies must have robust systems to control the elements causing variation of prices in the market. A few factors causing variations are here.

1. Great variation in quantity lifted by wholesalers. Big wholesalers will be able to avail high quantity discounts and pass it on to the market while small wholesalers might not be able to do so. Companies must try to keep a balance between small and big dealers. In any market, the company should not be dependent for more than 30% of sales one wholesaler. It is a good practice to restrict big wholesalers from doing retail sale.

Finally, a reliable retail network is needed so that the material reaches the end customer. Often the handling agents for the commodity companies can also sell material. The handling agents are generally moneyed people because the volume of work they do for the companies needs money and muscle power. While trading, they are able to trade much more quantities than other wholesalers because they can give material on credit to retailers for longer periods.

2. Diversion of low priced material to high price markets because of no control on the transport. Logistics is the key for commodities. If the route to low price market is through a high price market, some dealers can show on paper that they are booking the material for the low price market but unload the material in the high price market, thereby having an arbitrage opportunity in the high price market. Commodity companies must have control on the material logistics. The material billed for a certain place does not get unloaded at a different place. The company needs to develop some system for this. This does not necessarily mean that the company arranges the transport vehicles.

3. Sudden price rise or fall when enough material already exists in the market. Prices are changed by commodity companies overnight. However, all the material is not consumed in the market. Old priced product is still available with some sellers. They do not mind selling it according to the old purchase price. Companies must be very vigilant and announce immediate price discounts to the existing material in the market when they reduce the price or announce the new wholesale price in the market immediately when they increase the price.

4. Variation in perception of a commodity brand in various pockets of the market. This will however not cause variation in the wholesale price within a pocket.

5. Availability of institutional material at select retail counters. Generally material for institutional sale have “Not for resale” marked on them. It is mostly sold at concessional rate by the manufacturers. The problem arises when this institutional material creeps into the retail market and disturbs the market prices. Companies must have a good vigilance system to monitor any outflow of institutional material into retail market.

6. Availability of counterfeit material in the market. This is applicable more for the known brands. The counterfeit material causes confusion in the market. Their price tends to be lower than the announced market price as sellers can average out their earnings.

7. Other factors: Stealth of material from the godowns without the knowledge of the company, cartelization by low price brands and leakage of impending price change information to selected channel partners are other causes which can hamper market price control measures of the company. Companies should develop full-proof systems for effective market price control mechanisms. Companies need to immediately and effectively communicate any price changes, especially hike to the traders and distributors. For this, technology can be the best medium as letters or updated price posters or salesman visit will have a lag time.

Apart from market price control, there are other risk factors also. For this, read the blog on Risk Management.