Data is a collection of numbers, labels, or symbols, collected through observation. It can be qualitative or quantitative variables about one or more persons or objects. When there is no structure to data, nobody can make meaning out of the numbers and names. Data organized in rows and columns carry specific meaning. A commodity company with a data driven approach takes decisions basis the data. Its transition to a brand will be faster than one which ignores data, other factors being constant.

To look at data and to make meaning out of it needs focus. It has to be inculcated as a culture in the company. It is necessary that all decisions are based on a data driven approach. All reviews must be backed with data.

Types of data

Types of data available with the company fall in three categories:

- System data: This includes data registered in company’s system through a standard software. Chances of error in data due to human estimation is minimal. A few examples of system data are sales volumes of customers, number of outlets selling our brand, purchase frequency of the customers, company’s production figures, number of quality complaints logged, etc. Company’s ERP system captures this data from the invoices.

- Market data: This includes data where the employees make estimates of numbers like competitor brands’ sales volume or shop share, retailers profile, number of outlets selling competition brands, production volumes of competition, quality of the competition brands, competition pricing, etc. are examples where of market data where the employees make estimate basis the interaction of people operating in the market. This is often accepted with a pinch of salt by the management as the biases of the sales person creep into this data collection.

- Agency data: This includes data collected by agencies either independently or for a commodity company when asked to do so. Data collection happens either by sample survey of consumers or through interaction of the trade partners/ influencers. Changes in consumers’ consumption behavior, growth trend of the industry, market share of the various brands, media consumption trend of the consumers, etc. are examples of agency data. This data is considered more credible by the management as there are no biases from the market research company.

Benefits of Data Driven Approach

There are several decisions which can be taken with more diligence if data is looked closely. They will yield better results. A few examples are below:

- Sales planning- If the sales team closely follows the purchase frequency of trade partners/ consumers, seasonality of the product and recent growth trends, it will be able to predict the sales forecast with more accuracy.

- Trade scheme devising- Last scheme’s achievement, timing of the last scheme, type of scheme influencing various types of trade partners, are important parameters, which if tracked will help in devising the next schemes. Often companies do not evaluate the scheme’s performance after scheme closure, thereby not learning from the failures.

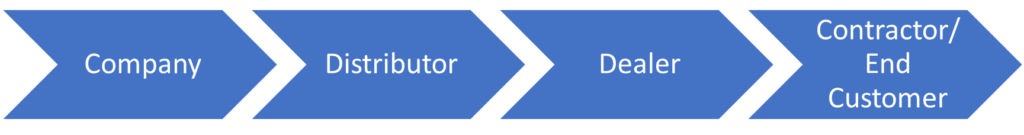

- Pricing decision- The pricing strategy of a commodity company will be successful only if it has information of the price waterfall existing in the market vis-à-vis competition or various element of the value chain.

- New product launch or capacity expansion- Companies should invest in new production facilities or storage facilities only if it has concrete information on the existing market size and competition market share. Basis this information only, the company will be able to decide the positioning strategy for its product. Similarly, when coming out with new products, the company must have all market data including consumers’ changing consumption trends.

- Advertising strategy- An important input is the media consumption data of the target audience. This data driven approach helps commodity company strategize media campaign diligently.

In a nutshell, data driven approach avoids decisions being taken on a gut by an individual. In a way, the decision maker takes the responsibility of the decision.