Distributor ROI or Return on Investment simply put is the total return as a percentage of the investment. All companies want to understand the ROI of its distributors. This is done to ensure that the Distributor is neither working by charging the Dealers exorbitantly nor is making so little money that he might lose interest in the product later. The profit margin is a major consideration for the wholesaler motivation to be associated with a brand.

Uncertainties in business

In case of building materials, there are certain factors which complicate the actual Distributor ROI calculation.

- There is seasonality in the product, which means that there is not a fixed sale every month. This also demands that Distributor has to invest additionally during some duration of the year on manpower, storage space and other infrastructure.

- Product price changes due to seasonality or due to raw material cost changes or due to structural changes in the external environment (entry of a new market player, exit of an existing competitor, changes in application cost due to change in price or unavailability of some other component or accessory which is needed for fixing or applying the building material, etc.) leading to varied Distributor ROI in an year

- There is no fixed storage/ handling/ transport charges per unit of the commodity as some material has to be stored by the Distributor for servicing the market and some material gets dispatched directly to the Dealers/ customers from the manufacturer’s premises, depending on the order size.

- Distributor is engaged in wholesale of multiple products, so it is difficult to allocate the various expenses, like manpower, rents, account-keeping, fuel, equipments, etc. to multiple products.

- Recovery of credit given by the Distributor from different dealers happens at varying periods. Credit terms also affect the price for the Dealer.

- A contingency like fire in godown, market shut down, transport strike, bad quality of incoming material, disruption in invoicing infrastructure, etc., might affect business for some time. This can affect Distributor ROI drastically in an year.

- Increase in cost of most of the inputs due to increase in sale is not a linear relation. Sale during the end of the month is higher than that in the beginning of the month due to increased activity by company sales personnel to achieve their targets, which means that the Distributor has to employ additional labour only for the last few days, arrange for vehicles at higher freights and get additional space for storage due to increase in incoming material from the factory.

Distributor ROI should be enough to cover for these costs and risks, plus yield a reasonable return for the Distributor to stay invested in the business. Else, he will stop making efforts to expand the business, which will hurt the commodity brand only.

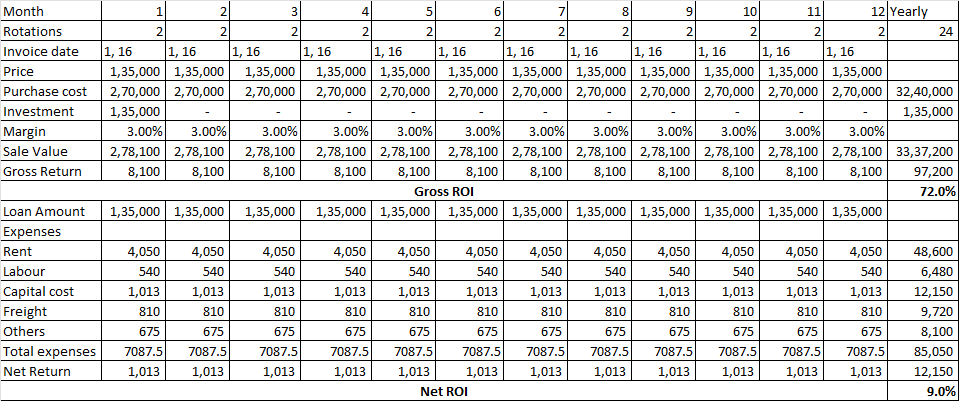

Simplistic case to calculate Distributor ROI

We assume that there is there is a fixed sale every month. There are no price fluctuations during the year. The profit margin on every transaction is fixed, say 3%. The initial capital invested by the Distributor in the first month of the year gets rotated, say two times in a month and he gets back the money from the Dealers after fifteen days of material delivery. The Distributor is engaged in the business of wholesaling a single product and all the expenses incurred are loaded on this product. There is no variation in these input costs over an year.

In the above scenario, due to two rotations from the initial investment in the first month, the Distributor earns 6% on his investment every month. At the end of the year, his Gross ROI is 72% (i.e., 12*6%). Now subtract all the expenses he has incurred in the year from the Gross Return and Net ROI can be calculated by dividing this Net Return value by investment. The various expenses incurred by the Distributor are fixed for an year. Say, rent is 1.5% of monthly purchase value, Labour 0.2%, Freight 0.3% and other costs 0.25%. Cost of capital is 0.75% per month of initial investment. Net ROI will be 9%.

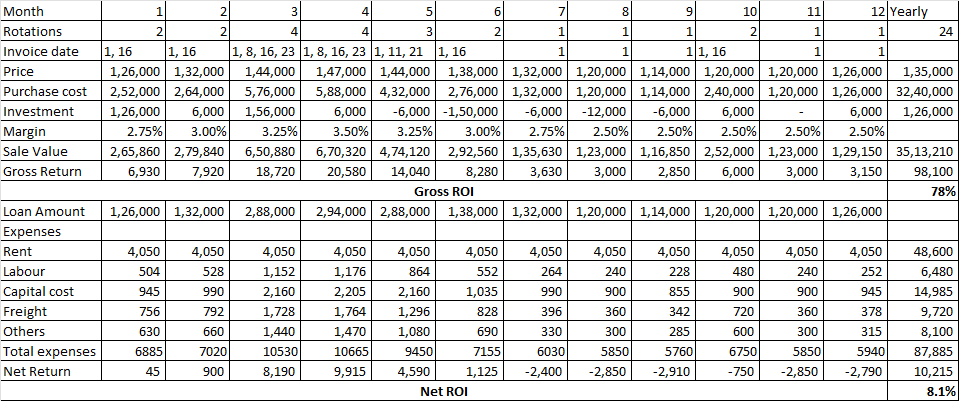

More complex case to calculate Distributor ROI

In the more complex case, we will assume that sale is not uniform in a year, so the Distributor will have to make additional investments during the year and a some portion of the investment made during the peak month of the year, will be idle in off-season month of the year. Below illustration provides a tool to estimate the ROI. However, here also, rent has not changed over the year, assuming that no additional space will be needed even during the peak season. The increase in costs due to higher demand of material handling resources or decrease in costs due to economies of scale has not been captured in the model.

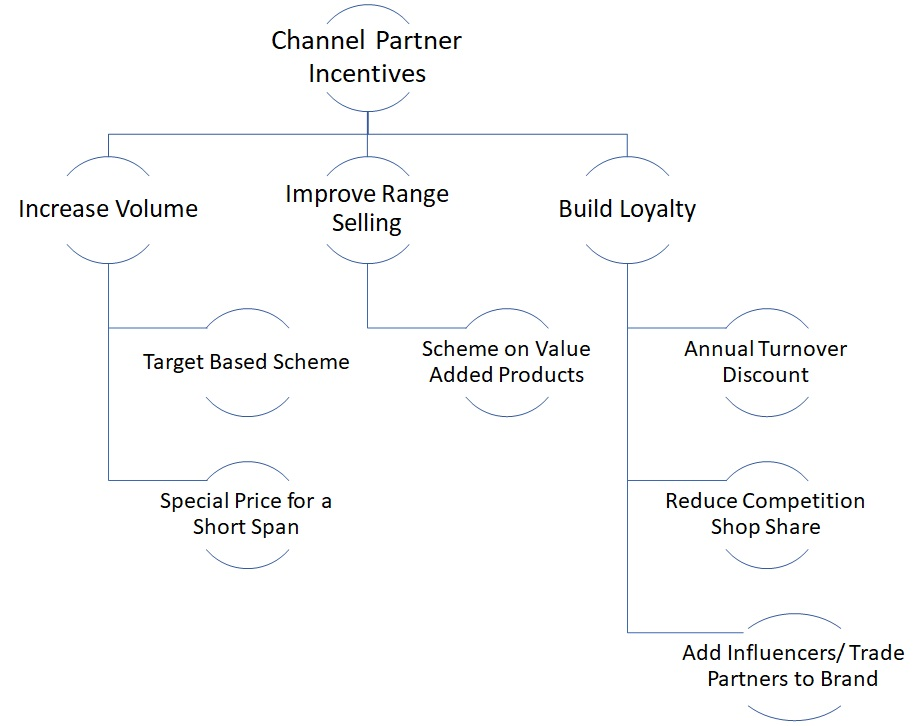

In the above examples, we have not included any Channel Incentive schemes which the company might be running for the Distributors or marketing expenses incurred by the Distributor for promoting the product in the market or for adding new Dealers to the network.